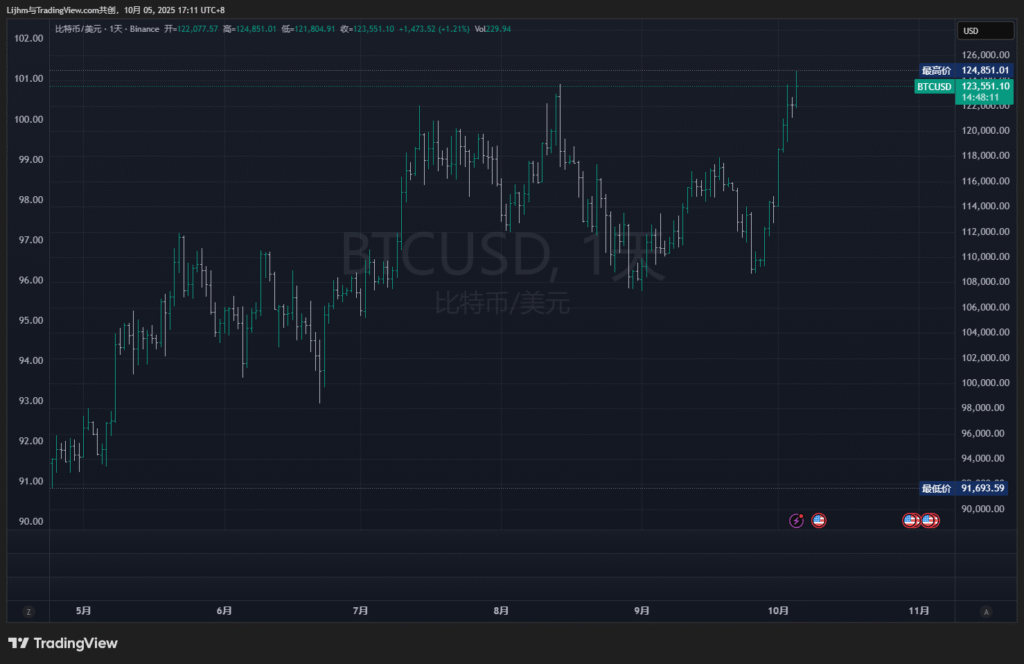

Today (2025-10-05), BTC broke above the July high and printed a new ATH. For me, this is a “process, not impulse” moment: if price holds into tomorrow, my Trend Hunter system will trigger a long entry.

Trend Hunter is a trend-following system designed to identify and capture sustained directional moves while avoiding the noise of sideways markets. It doesn’t try to predict tops or bottoms; instead, it aims to enter once momentum is confirmed and ride the trend until it fades. In short, it’s a framework for turning trends into structured trades rather than emotional reactions.

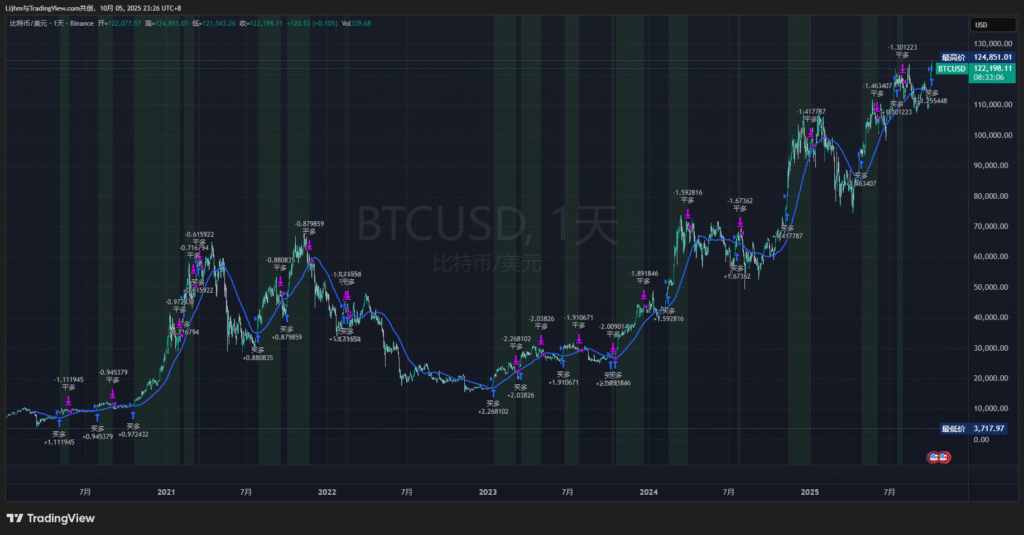

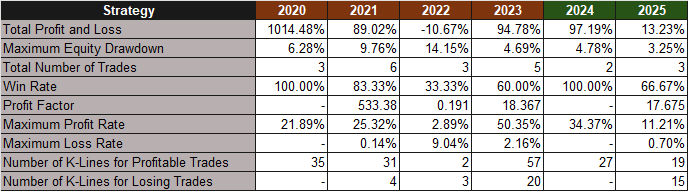

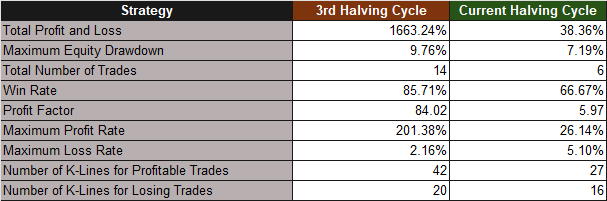

Looking back, let’s review how the strategy has performed in the previous and current market cycles.

During the previous cycle (May 12, 2020 – April 20, 2024), Trend Hunter achieved a total return of 1,663.24%, with a maximum drawdown of 9.76% over 14 trades, an 85.71% win rate, and an extraordinary profit factor of 84.02. It was a period defined by clear directional conviction and exceptional volatility capture.

In the current cycle (April 20, 2024 – present), the market has been more measured: total return 38.36%, drawdown 7.19%, 6 trades, 66.67% win rate, and profit factor 5.97 . While less explosive than the previous phase, the current cycle is gentler (smaller samples, milder upside) but drawdown is lower; win rate and PF are still solid—signals remain valid though less explosive than the last cycle.

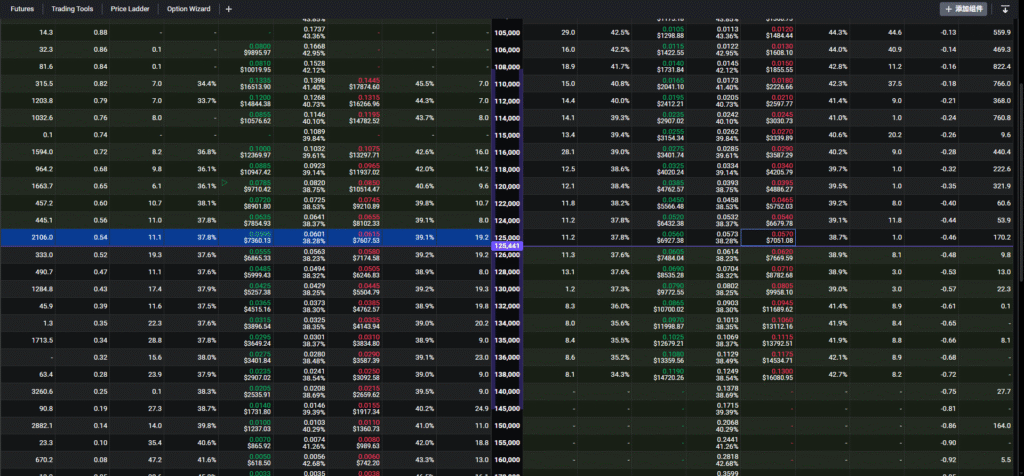

Given the present setup, I plan to express my bullish view via options instead of margin spot. My position will be built with the BTC-28 NOV 2025-125,000-C call option. The current premium is around 0.0641 BTC per contract, and I intend to buy four contracts if Trend Hunter confirms entry tomorrow.

The total cost—0.2564 BTC—also represents my maximum possible loss, fully within my self-imposed limit of ≤ 0.3 BTC.

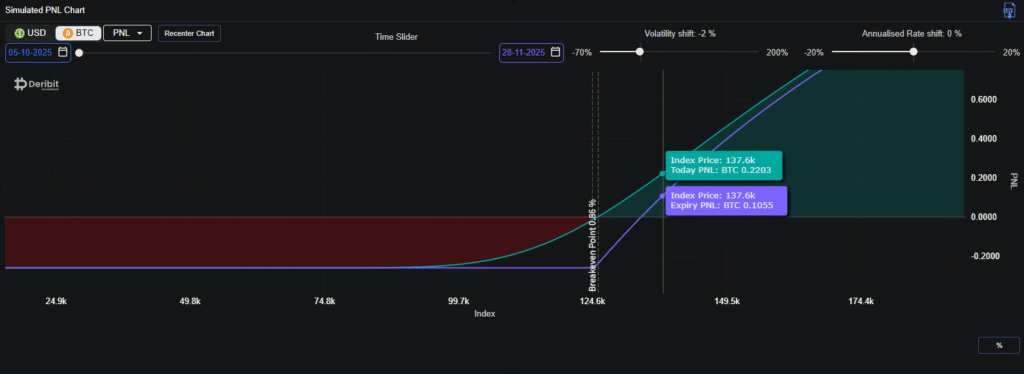

At expiry, the breakeven level is approximately 133,600 USD. If BTC finishes below 125,000, I lose the full premium (−0.2564 BTC).

If BTC rallies to around 137,500 USD—a ~10.5% move consistent with the average gain of past winning trades—the projected profit is roughly +0.107 BTC.

Based on an average near-ATM delta of 0.45 per contract, my four contracts represent about 1.8 BTC of notional long exposure, giving an effective delta-leverage of ≈ 7× on the invested capital. As the price rises further into the money, delta increases, and the position’s sensitivity to upside accelerates—an asymmetric payoff I value highly.

The key advantage of this setup is asymmetry—risk is strictly capped while upside remains open. There’s no margin risk, no forced liquidation, only time decay as the silent cost. The main challenge is theta erosion: if BTC consolidates for several weeks without a clear breakout, the option will gradually lose value. My rule is simple: enter only upon Trend Hunter confirmation, monitor for a breakout above 133.6 k within two weeks, and if it stalls, either roll to the December 26 expiry or close the position early.

This trade embodies my preference for discipline over prediction. At the top of a bull cycle, emotions can be louder than logic, but I prefer to let data decide. Trend Hunter doesn’t chase—it follows. By using call options, I can stay aligned with the system’s signal while keeping losses contained and capital efficiency high.

This is the essence of Trend Hunter — turning uncertainty into structured asymmetry.